The most important fact about a Ponzi scheme is that law enforcement never solves it, because a Ponzi scheme always solves itself first—through self-destruction.

By which I mean: Welcome to the rest of the 2020s.

Strap in, because we’re now entering the endgame of the world’s greatest Ponzi scheme.

We’re about to see the unmasking of the government’s most nonsensical belief: Debt doesn’t matter. This is the belief that government can print all the money it wants because, well, it’s the government, and it has no need to bend the knee to financial prudence because it has a monopoly on currency.

As the debt-deniers assert: The only risk that government must navigate is inflation, and the simple solution for that is to just raise interest rates to quell consumer spending, thereby cooling inflation.

Easy peasy.

Alas, such a belief is, in the best possible scenario, blindingly stupid and historically naïve.

$900 Billion Interest Payments!

Let’s start with blindingly stupid. Stupid always seems a good starting point when discussing government, its mandarins, and the ivory tower economists who push these newfangled beliefs that 2 + 2 = 19 because numbers are just a false construct… or something like that.

Truth we do find in at least a part of that belief: inflation is the risk to the “debt doesn’t matter” lie.

We’re seeing the direct manifestation of that truism right now.

Interest payments on the national debt hit $475 billion in Uncle Sam’s fiscal year 2022 (the federal fiscal year runs Oct. 1 to Sept. 30). That was a record.

Through the first 10 months of this current federal fiscal year, interest payments on the debt have already shot up to $726 billion—a painful 53% higher than all of last year.

Moreover, we still have two months left in this fiscal year. America’s debt-servicing costs will ultimately push up against $900 billion. That’s about 15% of the $5.8 trillion federal budget, as laid out by the White House last summer. Truth is, that percentage rate will be slightly smaller because the budget will exceed $5.8 trillion… a brilliant strategy of winning by losing.

At some point, every Ponzi scheme collapses because the scammer cannot keep the money flow going. Uncle Sam faces that exact risk if interest rates keep rising. His borrowing costs will spiral out of control. America already sells boatloads of debt just to pay the interest payments on existing debt. As interest rates rise, D.C. has to borrow ever-more money simply to make interest payments.

It’s like taking out a bank loan just to pay the monthly interest on your credit card. Now, you have another debt obligation to pay off—the bank. At some point, the music stops.

Energy Prices: The Only Reason Inflation is Down

Uncle Sam’s sharp increase in borrowing costs is entirely the result of the Fed hiking interest rates too quickly over the last year or so, to more than 5.5% from basically nothing.

Debt proponents would like us to believe that everything will be fine because inflation will force a self-correction. Jobs will be lost, people will stop spending, unicorns will return, and all will be copasetic with the world.

Yet, that has not happened.

The job market hasn’t fallen apart.

Consumers continue to spend, and they’re doing so by taking on even more debt. (Credit card debt in America has surpassed $1 trillion for the first time ever.)

Inflation has come down, but only because energy prices came off their highs sharply…

The energy component of the most recent inflation report was down 12.5% between July 202 and July 2023. Gasoline prices were off 20%. Natural gas, which lots of Americans use for cooking and fireplaces and whatnot, fell 13.7%. And fuel oil, which lots of Americans on the East Coast and Midwest use to heat their homes, is down nearly 27%.

But food was up nearly 5%, with the “food away from home” component (we’ll call that “restaurant meals”) up 7.1%. Electricity, up 3%. New vehicles, up 3.5%. Clothing, up 3.2%. Medical commodities (prescriptions, medical equipment, etc.), up 4%. Shelter, up 7.7%. Transportation services, up 9%.

Aside from gasoline and fuels to cook and stay warm, every basic expense in life is well above the Fed’s 2% target … and—golly gee, what’ya know?—inflation has started to nose back up because oil prices are heading higher again after bottoming out over the summer.

The Fed Will Cut Rates to Stave Off The Ponzi Scheme Collapse

The odd irony here is that, ultimately, interest rates will be coming down very soon. But not because the Fed has whipped inflation. It will be precisely because—say it with me—Debt. Does. Matter.

We’re going to end up in an environment defined by elevated inflation, low interest rates, and average job growth—a very strange mashup of Goldilocks Meets Hyperinflation (Goldi-flation?). The Fed must reduce the government’s debt-repayment costs before those costs spiral out of control, lest the Ponzi scheme collapse sooner than it should.

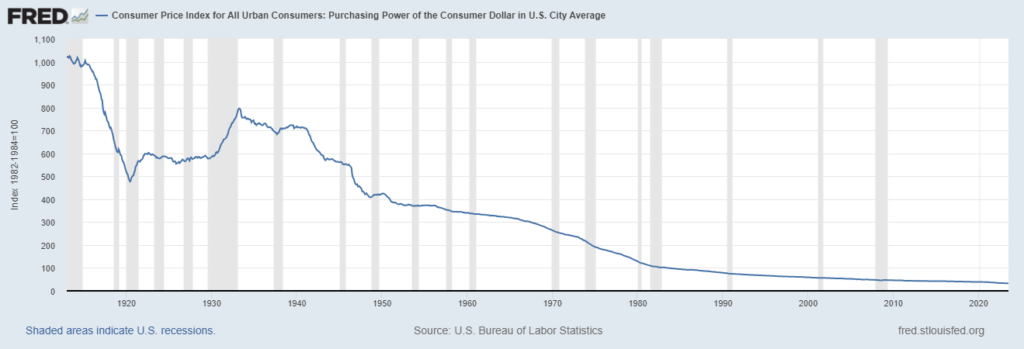

Some will argue that worrying about U.S. debt repayment “is not the Fed’s mandate.” So what? Destroying the value of the dollar over the last 109 years was not the Fed’s mandate either, and yet here we are…

Fed governors have to make a choice: Save the baby or save the bath water.

It will choose the baby… and the bath water is going to overflow and create a new crisis soon enough.

Now, as for historical naivete…

Government Controls Currency, Not Money

Government might have a monopoly on currency, but it has no monopoly over money.

What I mean is that the U.S. government can control all the dollars in the world—but those dollars are just currency, a fiat representation of money.

The government, however, does not control the street value of cigarettes. Nor does it control the value of cryptocurrencies. The value of gold and silver. The value of online gaming tokens (which Venezuelans are using in their own hyperinflationary economy).

Those are currencies too… money in a different form.

So for debt-lovers to argue that the government has a monopoly on money is flat-out boneheaded.

If Uncle Sam’s minions in D.C. were to assert that they can issue trillions upon trillions upon tens of trillions of dollars in additional debt, or simply print tens of trillions of additional dollars because, well, “We’re from the government and we’re here to help,” we would hear a collective guffaw from across America.

Americans could revert to other forms of spending and saving. Regardless of government mandates. Period.

That has been the world’s reality since at least the collapse of the Roman Empire 1,500 years ago. No reason to think that society’s collective lizard brain is so much more advanced that it would gladly take it in the shorts if the government said, “Bend over.”

So, what’s to come?

The self-destruction of the world’s greatest Ponzi scheme yet: American debt.

Grab the popcorn (and some gold and bitcoin and Swiss francs)—this promises to be a helluva show.