By my reckoning, we have about four years.

Probably not gonna be terribly good years. Might not be horrible, though. Either way, four years to prep for the cake that’s already baking is all we’ve got.

This cake of which I speak is the Cake of Reckoning.

It’s a vile cake. No one wants a slice. The key ingredient is the acrid ashes of a once-dominant nation brought to its knees by its own people. In this case, those people are the side-show freaks who have played their roles in Congress and the White House over the last 40 years.

Their financial incompetence, arrogance, and stupidity have led us to this point—where America is now just a few short years away from the mother of all “Come to Jesus” meetings.

Here, I’m going to step back from my role as omniscient narrator of today’s dispatch and allow a few other organizations to spell out the reasons why disaster stalks us.

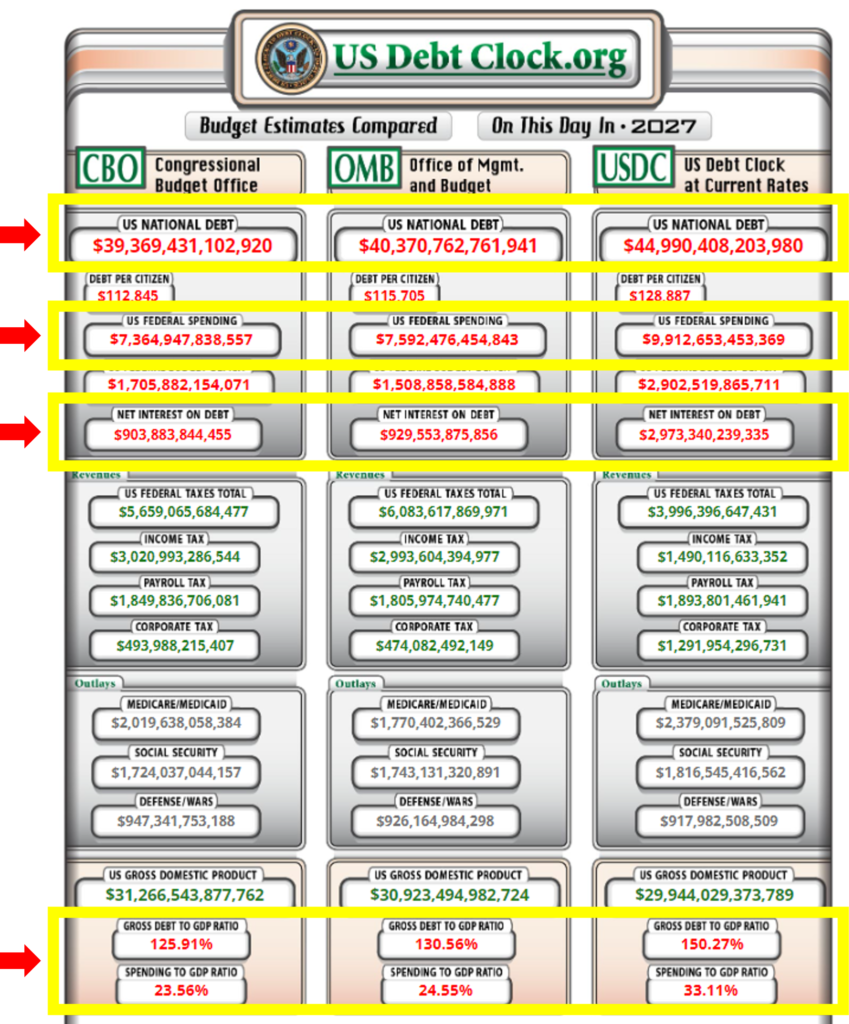

Below is a chart from USDebtClock.org. It’s a look-ahead to what the website calls “Budget Showdown 2027.” (Note: If you’ve been reading Field Notes and/or Global Intelligence Letter for a while, you’ll know that for about two years now I’ve been presaging a monetary crisis in America in the 2027/28 timeframe, and here we have USDebtClock confirming my suspicions.)

On to the chart:

Those are three, side-by-side comparisons of what America’s fiscal situation will look like in 2027. One from the Congressional Budget Office, one from the Office of Management and Budget, and one in which the USDebtClock folks simply extrapolate today’s situation into the future.

Which one to believe?

Well, I’ll say that both the CBO and OMB have typically undershot reality. Not their fault, really. It’s impossible to predict how moronic politicians can be in their spending, as well as their unhinged take on debts and deficits.

And guessing what the Federal Reserve will do with interest rates is also a roll of the dice.

Thus, I’d argue that history says the USDebtClock extrapolation will likely prove to be closest to reality once we arrive.

But whatever the situation, the situation will be bad.

Note the data I’ve highlighted…

U.S. national debt will be in the $40 trillion range. That’s a hard number to wrap your head around. So, to put that into perspective: If you spent $1 every day for each of the 4.543 billion years that Earth has existed… you’d need to spend nearly 25 of Earth’s lifetimes just to reach $40 trillion.

But what does $40 trillion mean in context of the American economy?

Well, look at the bottom numbers I boxed in. Debt in 2027 will amount to as much as 150% of the entire U.S. economy. That’s truly banana republic territory. But worse, consider that “Spending to GDP” is 33%.

Now, stop and think about that…

Spending includes debt—the deficits Uncle Sam’s freak-show minions rack up every year because they budget about as well as a potted geranium plays the piano. So, in theory, debt would be growing pretty much in line with spending.

And yet Debt-to-GDP explodes to nearly five times Spending-to-GDP. Why is that?

Because of interest expense on the debt.

When a country is continually spending more than it’s bringing in, it has no way to pay down its existing debt. So, it just accumulates more and more and more debt, which means that country’s debt-servicing costs—its annual interest payments—continually expand.

Thus, debt at 150% of GDP largely reflects the fact that America is borrowing more and more and more and more money just to pay the interest on debt that it borrowed to pay interest on the debt that it borrowed before that… to pay interest on the debt that it borrowed before that.

Basically, America is already well-entrenched in a debt spiral.

We just haven’t reached the tipping point yet.

But that point is fast approaching.

Look at the second and third yellow boxes in the chart.

If the USDebt Clock extrapolation proves to be accurate, net debt payments on Uncle Sam’s Mt. Everest of IOUs will amount to 30% of annual, federal spending. Today, it’s about 11.3%. (By the way, net interest payments today are only marginally less than D.C. spends on defense, and D.C. is the largest spender on defense in the known universe.)

So there you have it: The four-year path to disaster.

Some will walk on the bright side of this street and pretend that the USDebtClock people are just curmudgeonly number crunchers painting America’s heinous debt situation in the worst possible light, despite the fact that this is simply an emotionless extrapolation of America’s existing situation.

Others will laughably exclaim, as a New York Times economic columnist recently did, that America doesn’t have to worry about the debt because it never has to pay it off… thus, debt isn’t an issue, only interest payments are.

Right. And that’s like saying the structural integrity of my house isn’t an issue… only the termites matter.

Problem is, America has no way to eradicate the termites. So, their numbers just keep growing year by year. Thus, integrity becomes part and parcel of the problem and the reckoning that must happen.

I’ve been tracking this pending crisis for years. I’ve been writing about this pending crisis for years. And I’ve seen over and over—and over and over again—how inaccurate even the nonpartisan government agencies are when it comes to long-range projections.

Again, not really their fault.

They’re guessing at jellybeans in a jar when there’s a maniacal jelly-bean maker constantly shoving more and more beans into the jar.

My bet is that the USDebtClock people are going to be wrong, too. Even their numbers are going to prove to be too conservative. Politicians, like zebras, don’t change their stripes. Regardless of party, they’re going to keep on doing what they do best: spending the nation into beggary.

Sadly, there’s nothing anyone can do at this point.

The debt is what the debt is, and there is no way to control it now, short of officially devaluing the dollar. That’s what FDR did in 1933. And what Nixon did in 1971. We’re not so advanced that overt devaluation is unthinkable.

But that’s a dispatch for a different day.

All you really need to do is remember the mantra: “Gold, Swiss francs, and bitcoin.”

They’re going to be some of your best friends in the end.