What goes up must come down

Spinnin’ wheel got to go ’round

Talkin’ ’bout your troubles it’s a cryin’ sin

Ride a painted pony let the spinnin’ wheel spin

– “Spinning Wheel,” Blood, Sweat & Tears

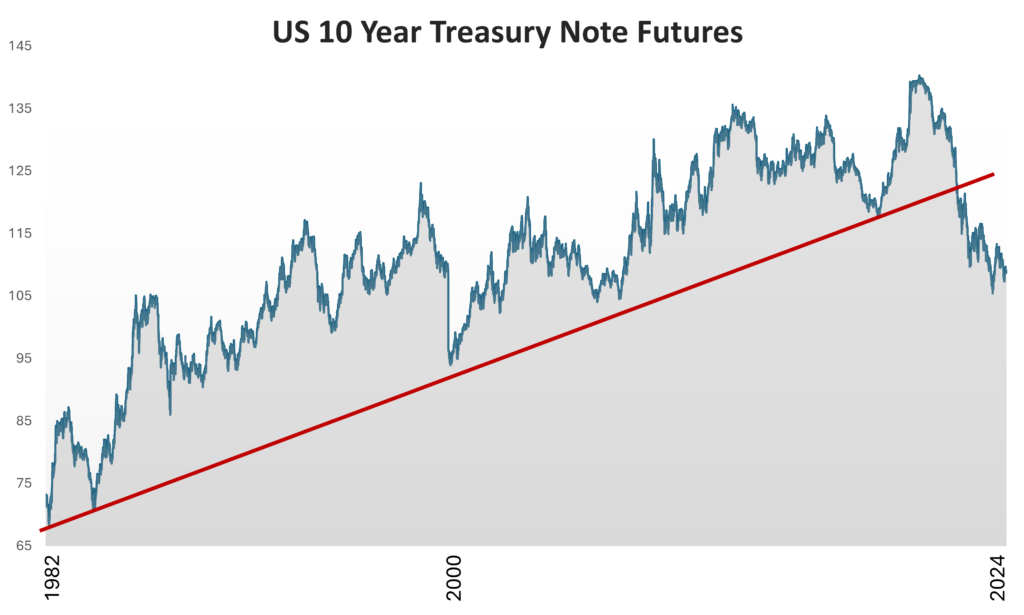

Today, we start with a chart.

This chart…

The message in a nutshell: Trouble is here.

As the header on that chart spells out, that’s a 40-plus year history of the price index for futures on the 10-year US Treasury note, America’s benchmark government bond.

I don’t want to go too deeply into financial gobbledygook here, but I have to tell you what a futures contract is so that the rest of this dispatch makes sense.

Basically, futures are contracts between two parties guessing the price of an asset in the future. These contracts are used for all sorts of reasons, but often to hedge against unexpected events or to lock-in a great price now.

They’re quite common among farmers who regularly rely on futures contracts for wheat, soy, corn, etc. to manage their Mother Nature risk or to grab big prices for fear that lower prices are coming.

So, that’s a futures contract—a bet on the future.

Now, back to that chart…

For the last four decades, bond investors were betting that the future was generally bright for America. The trajectory was “ever up” for the most part. In the upside down world of bonds, ever up meant that bond prices were rising as bond yields were falling… meaning interest rates (the yields investors expected on their bonds) were pretty much “ever down.”

A happy world for America.

Low interest rates make homes and cars and credit affordable for nearly everyone.

Sure, there were “down” moments during those 40 years. All markets have downs. But the long-term trend was “up.”

And then it wasn’t.

Futures prices back in the spring of 2022 broke through the 40-year trend line. That could have been a one-off moment, so maybe it wouldn’t mean a whole lot.

But that one-off moment has turned into a two-year trend—you can see on the right of the chart—that has seen bond prices plunge… which implies that Treasury yields are rising.

Some of that is tied to the Federal Reserve raising interest rates like a freaked-out banshee.

Some of it, however, is because bond investors (always the smartest guys in any room) are telling the world that bad juju has come a’knocking in America.

For several years now, I’ve been warning of this moment’s arrival. I was writing that bond investors will reach a point where they look at America’s ever-mounting debt (now $35 trillion and counting) and throw up their hands in protest.

See, the bond market is far more powerful than any governmnet, and particulalry a heavily indebted country that has few, real financial options.

The American government likes to think that it’s all-powerful. It likes to believe in the beautiful lie that it can use the power of the printing press—and the fact that the world needs to buy US dollars to manage global trade—to run the economy.

Alas, lies are always exposed at some point, and that chart tells you that the Come to Jesus Revival has commenced…

The fact that 10-year futures prices are in decline says that bond investors are expecting lower prices for 10-year Treasury paper, which by definition means higher yields.

Higher yields indicate higher risk, and they mean big trouble for a country that survives only because of the debt market.

The bond market is warning that severe challenges are afoot for America, so they’re only willing to own US debt if they’re paid higher yields to compensate for the growing risks to America’s fiscal situation.

These higher yields are forcing the US government to pay bigger debt-financing costs—the interest rates Uncle Sam has to accept in order to sell all the debt he has to sell to keep the country running.

This year, the US will pay more in debt-repayment costs than it spends on defense—a projected $870 billion on debt-interest payments vs. $822 on defense. We all know how much America loves its over-the-top defense spending. The fact that interest payments will exceed the payments for bullets and bombs should be a troubling sign to anyone.

It’s certainly a troubling sign to bond investors.

We could very well reach a point where bond buyers simply stop buying US debt because they either fear the growing risks, or because they want to force the government to address the problem before it’s unfixable.

Everyone knows the only way to make D.C. act is by forcing a crisis.

Not enough people are paying attention to that chart.

It’s not like it’s readily available anywhere (I had to methodically build it by collecting 40 years of data), and it’s not like the mainstream is watching this stuff. If it’s not news at the moment, then there’s no reason to report on it now.

But quietly breaking that 40-year trend line is a canary in the debt mine.

It’s a very significant sign of problems that are already here.

The US economy and the US dollar will suffer in the years ahead as this plays out.

Which is why I continually urge my readers to own gold and non-dollar assets.

Even if it’s something as simple as opening a bank account in Ireland (yes, you can do that as an American), you absolutely want to stash some of your assets outside the greenback. Or own a currency ETF (I’ll be writing about my favorite one in the June issue of Global Intelligence Letter).

Whatever you do, have some wealth outside the dollar.

The bond jockeys really are the smartest guys in any room—and they’re telling the world that, after 40 year of “ever up,” we’re now in a new paradigm.

And that paradigm is going to be truly problematic for America.