Inflation is legal counterfeiting. Counterfeiting is illegal inflation.

– Robert Breedlove, bitcoin-focused entrepreneur & philosopher

By the spring of 1542, British King Henry VIII was in a bad way.

His lavish lifestyle and spending on pointless wars had left the monarchy in a financial fix.

So, Henry gathered his minions that May—and issued a secret order that slowly robbed the English people…

The Royal Mint was to begin reducing the amount of gold and silver in the country’s coins, thereby reducing precious metal consumption and increasing the number of coins in circulation that Henry could use to pay off extravagant debts.

Henry also introduced a new testoon, a coin that had failed a few decades earlier in the late-1400s. (Testoons later became known as shillings… a coin worth 12 pence.)

This new version of the testoon was supposedly a silver coin. But Henry, desperate for money, had the Royal Mint fashion testoons from copper overlaid with a very thin veneer of silver.

Too thin, it turned out.

Within a couple of months, the silver began wearing away on Henry’s nose protruding from the coin’s face…

Realizing that testoons were almost entirely copper, not silver, merchants began discounting their value.

Just another failed governmental effort at hoodwinking the people by debasing their money…

And as they always do, the people caught on.

Real silver coins began disappearing from circulation as Britain’s common folk stashed them away to protect against inflation.

Nearly 500 years later, not much has changed. Which is where we now segue from Henry VIII to modern America.

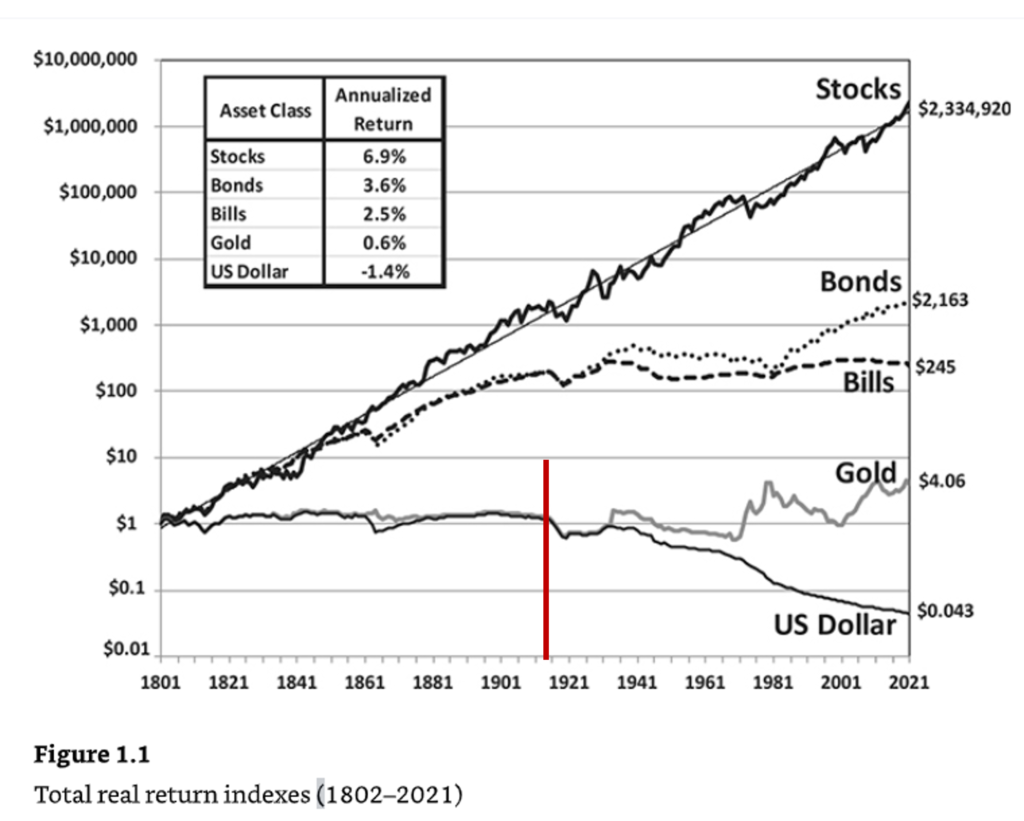

I saw this chart the other day…

Dividend Growth Investor compiled that chart—220 years of real returns across various assets.

I specifically want you to focus on the red line. I put that there.

To the left of that line is a period full of crises in America—bank runs, stock-market crashes, financial panics, etc. But through it all—over more than a century—the dollar managed to hold its value quite well.

To the right of that line marks the existence of the Federal Reserve, a creature created when fat-cat bankers who wanted to be even fatter convinced the public and politicians that America needed a central bank to prevent the crises of the past from happening all over again.

And what has that brought us?

A black line that has steadily gone lower and lower…

That, dear reader, is the best visual I can show you to demonstrate how government debases our money.

That’s the value of a US dollar—pre- and post-Federal Reserve.

Left to its own devises, the dollar, by way of a free market and the light hand of government, repairs itself and maintains long-term stability, despite short-term trouble…

Under the guise of protecting the American economy from crises, crashes, and panics, however, the Federal Reserve has destroyed the value of the money in our wallets.

They’ve done this purposefully… through nonstop expansion of the money supply to create inflation that, then, allows government to spend unrepentantly—because the value of the money they’re spending is forever in decline… which allows them to repay debt with increasingly worthless paper.

Nothing much we can do about that right now.

Efforts to disband the Fed—though they pop up every now and then—are never going to succeed.

Too many vested interests at this point, and not a single one of them cares a damn bit about the American hoi polloi.

But… as the British hoi poolloi did all those centuries back, we can protect ourselves.

Not by owning US dollars. Dollars and cents are the root cause of the evil at hand…

So, we have to venture outside the purview of the Fed, to assets the Fed cannot control: gold and bitcoin.

This is a tired refrain from me… I get that.

“Look, Madge—that Jeff guy is writing about gold and bitcoin again. I think I have a bingo!”

Nevertheless, solutions to certain problems are what they are.

You either take the aspirin or Tylenol, or the headache doesn’t go away…

Same thing: As the dollar declines, you pack away gold and bitcoin.

That chart is proof that dollar debasement is baked into the rancid cake. A debased dollar is not a new thing.

It’s not because of inflation.

It’s not because of Joe Biden.

It’s not because of Trump before him.

It’s not because of any one president or any one political party.

It is entirely because the Federal Reserve’s original, secret purpose was to hoodwink the American people in order to fatten the fortunes of the bankers who created the system.

(And remember: The Fed is not a governmental agency like, say, the Treasury or the Department of Education. It’s a semi-private business. The stockholders of the Fed’s 12 regional banks are all private banks. The Fed chairman does report to Congress, but Congress has no say over what the Federal Reserve does.)

People can hold all the dollars they want, and they can believe the US currency is King Dollar.

But history has a very different story to tell…

Those who understand the power of that chart above will reflexively understand why the US dollar is the modern testoon.

And why the smart-money crowd is packing away gold (and silver) and bitcoin as the debasement continues…