This Is The Future Of Sports … and Everything Else

Back in January, the University of Georgia Bulldogs football team won the NCAA National Championship. I won, too. And no—I did not bet on the game.

I bet, instead, on owning Georgia’s Sanford Stadium, one of the most famous stadiums in college sports.

In the fall of 2021, back before the term “metaverse” was flying off everyone’s lips, I hopped onto a metaverse website called Next Earth and started buying university stadiums all over America, and one professional baseball stadium in Japan. (I initially wrote to you about these investments at the time here.)

The metaverse is a new, emerging iteration of the internet that will see it morph from a static 2D experience into an all-encompassing 3D version in which the web exists all around you. Soon, we’ll all be chatting, working, studying, and hanging out in these 3D online worlds using virtual-reality glasses and augmented reality technology.

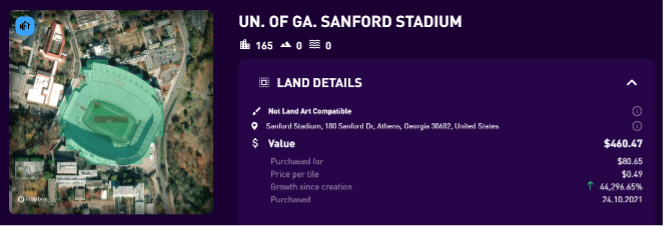

As I write this, my investment in the metaverse version of Georgia’s Sanford Stadium has an estimated value of more than $460, up over 470% from my original cost of $80.65 back in October 2021.

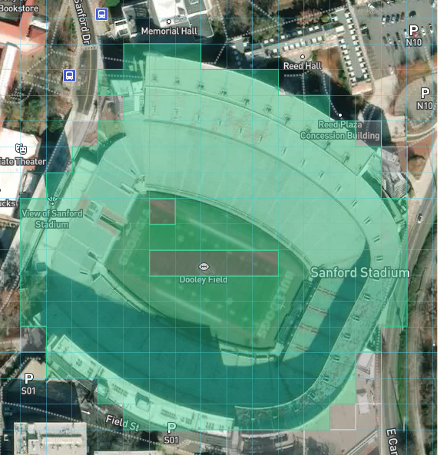

This is what I bought—every square in green is mine:

And this is what my investment looks like as a non-fungible token, an NFT:

I’ve been writing to you about NFTs for quite a while now. These are the one-off, one-of-a-kind crypto assets that initially gained fame as digital art that’s often represented by childish pictures of pixelated monkeys or punks or whatever.

But as you can see from the image above, NFTs can also represent other kinds of assets—in this case, digital ownership of a stadium in a metaverse known as Next Earth.

This is a trend these days… a move toward digital land ownership and the opportunities it represents. Indeed, this is how CBS News reported on it last year:

Large corporations and institutional investors are gobbling up choice digital real estate, with virtual parcels being bought up almost faster than the environments can be created.

Prices for space in the connected virtual- and augmented-reality environments known as the metaverse shot up last year, with sales of digital property hitting $500 million. The trend could make the virtual real estate industry a $5 billion market by 2026.

Many businesses see digital real estate as an opportunity to market their brands and engage with customers.

I was early into this trend.

I snapped up a metaverse-based cryptocurrency called CEEK VR in the summer of 2020, spending $191.95 for 20,266 tokens. Sixteen months later, as the notion of “metaverse” was taking off, I sold those tokens for just shy of $20,000.

And I started putting some of those profits into digital land because I understand where the metaverse is going and the revenue potential it represents for companies and brands—and university athletic departments.

They’re all going to have a metaverse presence and want to control digital land associated with their brand.

Gucci, Atari, JPMorgan, Nike, global banking giant HSBC, accounting firm PwC, Adidas… those are just some of the corporate names that now own land in the metaverse, where they are building out their brands for a new base of consumers who will be shopping, playing, and entertaining themselves in a variety of metaverses that are currently under construction.

My bet, as I laid out in that original story in October 2021, is that university athletic departments are going to be players in this world, too. Their fan bases are gargantuan and spread out globally.

By owing their stadium assets, they can create experiences in the digital world that keep their fans (and alumni donor base) more deeply connected to the team they love.

Frankly, if I could wander into Louisiana State University’s Tiger Stadium from here in Prague, where I live, and watch my beloved Tigers play, surrounded by the real-life ambience of that stadium on a South Louisiana Saturday night in the fall, I’d gladly pay an annual subscription for that.

And I absolutely know fans like me would just as gladly pay for that as well at the University of Georgia, Alabama, Mississippi State, Florida, Iowa, Iowa State, Minnesota, North Carolina State, Texas Tech, Boston College, Virginia Tech, West Virginia, and others.

Which is precisely why I own all of those stadiums.

I went shopping for them when no one was really thinking about what the metaverse could truly become, which is why I was able to snap up these stadiums at prices ranging from just $21.67 for Kobe Stadium (a professional baseball stadium in Japan) to $131.49 for the University of Minnesota’s Huntington Bank Stadium in Minneapolis.

All told, I spent exactly $2,220 buying 30 stadiums.

Today, Next Earth values my digital properties at $12,490… meaning my investment is up 463% in 18 months, a 217% annualized return.

Could I sell them for that price?

No idea, really.

But I’m certainly not going to try to sell for that amount just yet.

I see much bigger gains in the offing as athletic departments begin to understand the value proposition of owning their facilities in the metaverse. There are just so many opportunities to create revenue streams that they’ve never had before and which could bring them tens of millions of additional dollars annually.

The only issue I have: I was too quick to tell the world what I was up to. Too many stadiums I wanted to buy were snapped up before I had to chance to start buying again.