Death and taxes. Supposedly the only two facts of life that are inevitable. I would disagree.

We also have sex, eating, sleeping, and doctor visits. All happen all the time. Meaning that if you find the right path—the right entry vehicle—you can profit as the world goes about the daily habits and vices that define humanity.

Which means, ultimately, that there’s good money to be made in the absolute basics of life.

I like that kind of money.

Easy money.

Sleep-well-at-night money.

Because no matter what goes on in the world, people do what people do. War, pestilence, economic tides, the Cubs winning the World Series… people out there are chasing sex, visiting the doctor, and always thinking about their next meal.

It’s that “thinking about their next meal” where I’m most intrigued as an investor.

People gotta spend on food. Or grow their own. And I don’t see a lot of corn fields and chicken coops around Midtown Manhattan or the Chicago Loop.

I do, however, see quite the assortment of supermarket and fast-food chains.

Solid businesses serving unquenchable needs.

And many of them pay solid dividends.

Which is really my point here today: dividends and the pursuit of income.

From the earliest days of my investing career in the mid-1980s, I’ve routinely focused on companies that pay a dividend, dull as that might be. In a world where companies futz with and fudge their books in all kinds of ways that are legal, gray, and downright scammy, dividends are proof that some level of corporate profits are real.

They’re also a little-understood reason why stock prices rise over time.

SUB

A lot of people will cock their head at the comment. Dividends make stocks rise? Isn’t that like the tail wagging the dog, El Jefe?

No. It’s not.

And, yes, dividends make stocks rise.

Or as I tend to phrase it: Consistent dividend growth leads to persistent stock-price growth.

For those who might want a bit of show-and-tell to back that up, I came bearing receipts…

PepsiCo.

You know this company—the parent behind the iconic soft drink brand, as well as food brands such as Frito-Lay and Taco Bell.

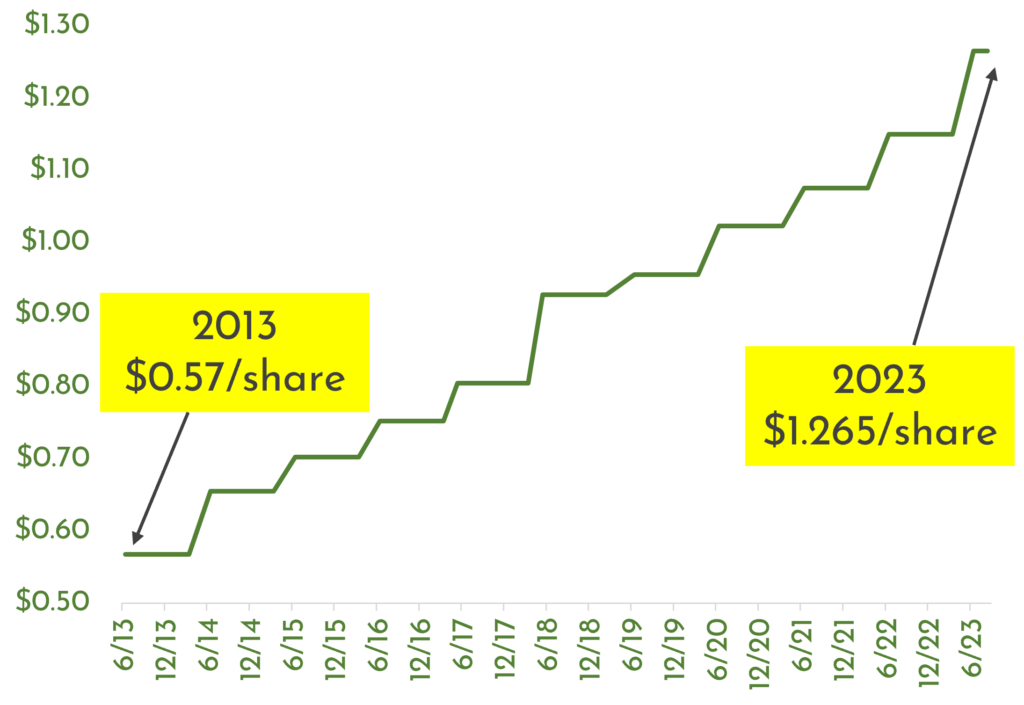

Let’s start with a chart:

That green line tracks PepsiCo’s quarterly dividend payments over the last decade. Back in the summer of 2013, each share paid $0.57 per quarter, or $2.28 per year.

As of this past summer, PepsiCo paid $1.265 per share per quarter, or $5.06 per year.

Remember that.

Now, this chart:

That’s PepsiCo’s annual dividend yield over the last decade. It consistently oscillated between 2.6% and 3.6%.

Remember that, too.

Now, this chart…

That’s PepsiCo’s stock price over the same decade-long period. I know you can’t see any numbers, so I will tell you that the chart begins with PepsiCo’s stock price in the $65 range back in 2013, and it ends on the far right, September 2023, at just over $170.

SUB

Now, one might argue that PepsiCo’s improving operations drove the share price. And to a certain degree, I will concede that point.

But let’s go back and consider those rising dividend payments and the historic yield on PepsiCo’s shares, and play the Counterfactual Game…

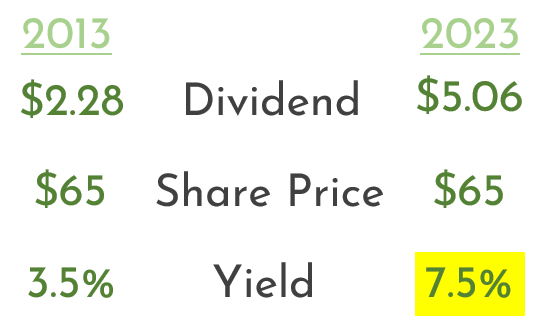

In 2013, PepsiCo’s $2.28 in annual dividend payments, relative to a $65 stock price, produced a yield of 3.5%, right in the historic range we expect for this stock.

However, if the stock price had never changed over the last decade even as PepsiCo’s dividends rose (as they did) to $5.06 per share, then PepsiCo today would be yielding 7.5%—a yield way outside the stock’s normal bounds.

But… if you apply a 3% yield (right in the middle of PepsiCo’s historical range) to that $5.06 in dividend income you get this…

At a 3% yield, a dividend of $5.06 would imply a stock price of $169.

How convenient that PepsiCo’s shares are $170 today—right where they should be, based on the company’s dividends.

Consistent dividend growth drives persistent stock-price growth.

SUB

Yes, earnings played a role in PepsiCo’s stock price—absolutely. Rising earnings, after all, drove those increasing dividends.

But what if PepsiCo had not put as much of those profits into raising the dividend payments? What if instead of growing its dividends at an annualized pace of 8.3%, PepsiCo had instead increased the dividend by half that amount—4.15% per year?

Well, annual dividends today would be $3.42 per share, not $5.06. And even if you assume PepsiCo is worth a 3.6% yield—at the high end of its range—the stock today would be closer to $95 per share, not $170

Dividends drive price.

Stocks like PepsiCo sate the hunger of and quench the thirst of consumers, regardless of the world’s economic state of affairs. And if they pay a nice dividend, all the better.

For the last 20-ish years, we’ve lived in a low-rate world. Finding safe, relatively stable income on your investments has been harder than finding Waldo hiding in a music festival crowd. For the most part, however, that wasn’t terribly painful because reported inflation was low, which meant interest rates were low, which in turn propelled asset price growth in stocks, bonds, crypto, and real estate.

Who cares about dividends when stock prices are climbing at a fast pace?

Alas, that world is gone.

Now, we’re in an inflationary era that’s not going away anytime soon. Asset price growth has either slumped or has slowed sharply. Suddenly, consistent income is much more important.

Which means finding solid dividend payers like PepsiCo represents some of the best opportunities today for safe, relatively secure, and meaningful income.

After all, people gotta eat.

Might as well try to make a buck or two off them as they do.