Central Banks are Buying This Asset … Which Means You Should, Too

In the crypto and investing spaces, there’s something called FOMO—shorthand for “Fear Of Missing Out.”

Today, I’d like to introduce you to FOLIA…

Fear Of Losing It All!

Now, to be clear, I have completely fabricated that acronym. Nevertheless, it accurately fits the mood of the moment among the world’s central banks.

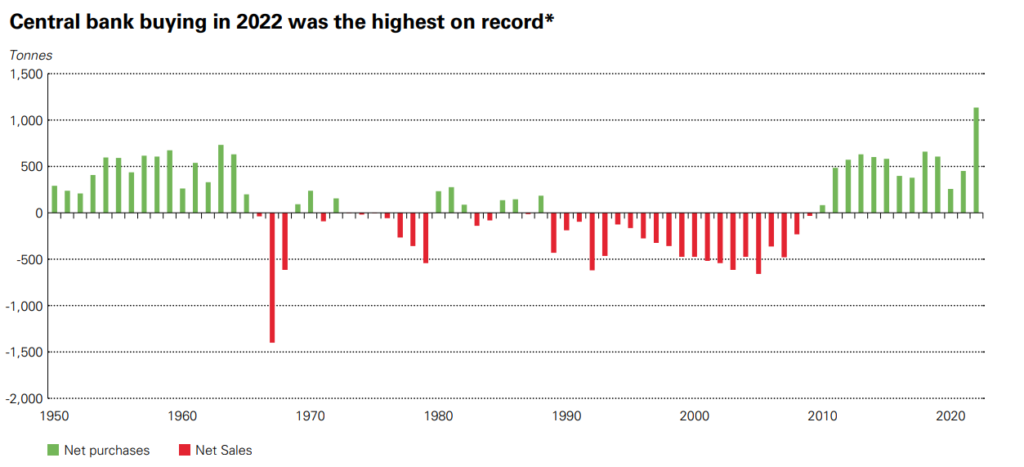

In 2022, they bought the most gold on record going back to 1950, when the World Gold Council started tracking this information.

Now, to be clear about another fact… central banks are not in the business of “playing the market.” They’re not buying gold on a hunch. They’re not investing. It’s not like the head of some central bank went for a haircut and caught wind of a hot tip from his barber.

They are prepping.

For disaster.

Central banks are worried—with good reason—that the U.S. dollar represents much too much risk at this point in history because of the duel threats of American politics and American debt.

First, American debt.

I’ve touched on this many times. The U.S. is the most heavily indebted nation in history. We’re now approaching $32 trillion in national debt, or more than 120% of GDP, literally banana republic numbers.

Yet, those numbers are very often sloughed off by way too many people in power. And I understand why. We’re America! We can spend whatever want and borrow from the world at favorable interest rates, and nothing bad ever happens.

And that’s true… until it’s not.

It’s the “until it’s not” that has the world’s central bankers hoarding gold.

They only buy gold for one reason: They are prepping for something big…

Then we have concerns about American politics.

It’s not news to tell you that American politics is exceptionally divisive these days.

The truly worrisome part, though, is that the two political parties’ cross-aisle hatreds could push the country beyond the brink of the current debt-ceiling debate, leading the nation into default.

A default would immediately turn the world away from the dollar.

So many countries hold dollars, and nearly every country relies on dollars to fuel global trade. If a default were to occur, those other countries are hurt financially because the value of their dollar holdings would plunge, and the cost of running their economies would rise.

In the aftermath, they’d vow to never allow that situation to happen again… which means they’d sharply reduce their exposure to the dollar.

That would see demand for U.S. Treasury debt decline, a problematic turn of events because Uncle Sam has all of that debt to service. In doing so, he is literally borrowing hundreds of billions of dollars just to pay the interest due on existing debt.

It’s like going to your bank and borrowing money just to make the interest payments on your credit card: You still owe the principal amount due to the credit card company, but now you’ve also added a new debtor—the bank—that you have to service as well.

A decline in demand for Treasury paper would, in turn, force America to entice buyers by offering higher rates on its debt… which ultimately means selling even more debt to afford those higher interest rates.

This is not a cycle that’s easily broken.

America can’t just ramp up economic activity to generate an abundance of new tax dollars it can use to pay down the debt without more borrowing. It cannot tax citizens and businesses enough to pay down the principal.

And it certainly cannot cut spending nearly enough to do the same without severely pinching the U.S. economy to such a degree that tax revenues plunge.

In a family, such a situation inevitably leads to a bankruptcy filing.

In the sovereign world of governments, it very often leads to a devaluation of the local currency.

By destroying the value of today’s dollar, government can repay the debt using cheaper dollars.

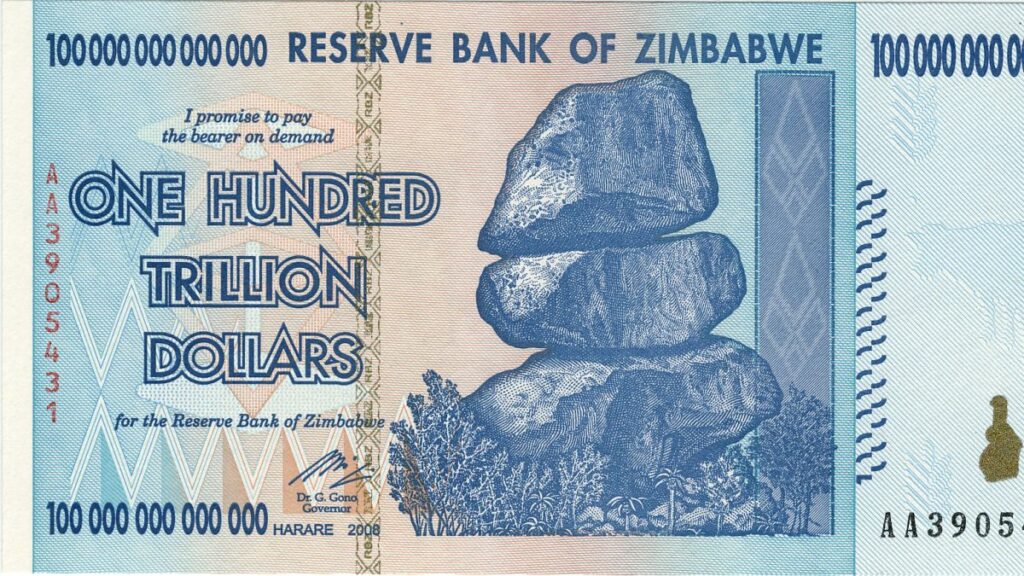

Banana republics like Zimbabwe are a good (albeit, extreme) example of this. That African nation devalued its currency by simply adding a bunch of zeros to each bill. Like this one… a one hundred trillion dollar note:

Imagine if Zimbabwe had 100 trillion in debt.

Well, this one note—which was once worth, say, $10,000—is now able to extinguish the country’s entire debt load. Suddenly, Zimbabwe has no debt.

But, of course, that 100 trillion is worth effectively nothing to the debtor and the paper becomes meaningless.

Again, Zimbabwe is an extreme example, and no one expects the same to occur with the U.S. dollar… at least not at that level. (Think about what happens to your wealth and your retirement if the dollar loses even 10% or 20% of its value.)

Still, this principle is why so many central banks are already loading up on gold—adding 1,136 tons of gold to their cumulative stockpile last year. They’re proactively protecting their economy against the long-term decline of the U.S. dollar.

They know a storm is brewing…

They suspect that crisis is going to center on the dollar.

Gold, they know, has a long, long history of protecting its owners from the impacts of a monetary storm.

It’s why FDR confiscated gold in 1933 to save the U.S. dollar from collapse.

It’s why Nixon severed the dollar’s ties to gold in the early 1970s when the rest of the world’s central banks were eagerly approaching the U.S. Treasury and trading in their overvalued dollars for gold at $35 per ounce.

And it’s why central banks are effectively doing the exact same today.

They are trading overvalued dollars for gold at roughly $2,000 per ounce.

They’d much rather own a shiny metal than a piece of paper backed by extreme debt and extreme political dysfunction.

Can’t say that I blame them.

FOLIA will do that to even the sanest central bankers.

And me.