You can put lipstick on a pig, but it’s still a Treasury bond.

Forgive the jangled phrasing. But it kinda works.

Per The Wall Street Journal, my old stomping grounds:

America’s Bonds Are Getting Harder to Sell

If you’ve been reading Field Notes for a while, this is not news. I’ve been writing about this for the better part of a year.

But let’s give the Journal its time in the sun:

A series of weak auctions for U.S. Treasurys are stoking investors’ concerns that markets will struggle to absorb an incoming rush of government debt.

A selloff sparked by a hotter-than-expected inflation report intensified this past week after lackluster demand for a $39 billion sale of 10-year Treasurys. Investors also showed tepid interest in auctions for three-year and 30-year Treasurys.

Behind their caution lies a growing conviction that inflation isn’t fully tamed and that the Federal Reserve will leave interest rates at multidecade highs for months, if not years, to come.

I added the bold.

I’ve been hammering on these points for a good while now. Going back many a long month.

The media always catch on, but it’s often well after the issue at hand has already become a trend… or, in this case, a problem.

And the problem of course is America’s gargantuan debt. I’m not going to give you yet another example of what $35 trillion equates to. We’re just going to go with the fact that it’s a ginormous amount of money that America has no hope of ever repaying, or paying down in any meaningful way.

Instead, I want to focus on that Journal headline and the idea that Uncle Sam is struggling to sell his debt.

See, that’s a big worry.

All that debt means America shoulders very large debt-repayment costs.

And the kick in the cajónes is that America doesn’t bring in nearly enough dinero every year to pay the costs of running this joint as well as the interest expense on all the debt.

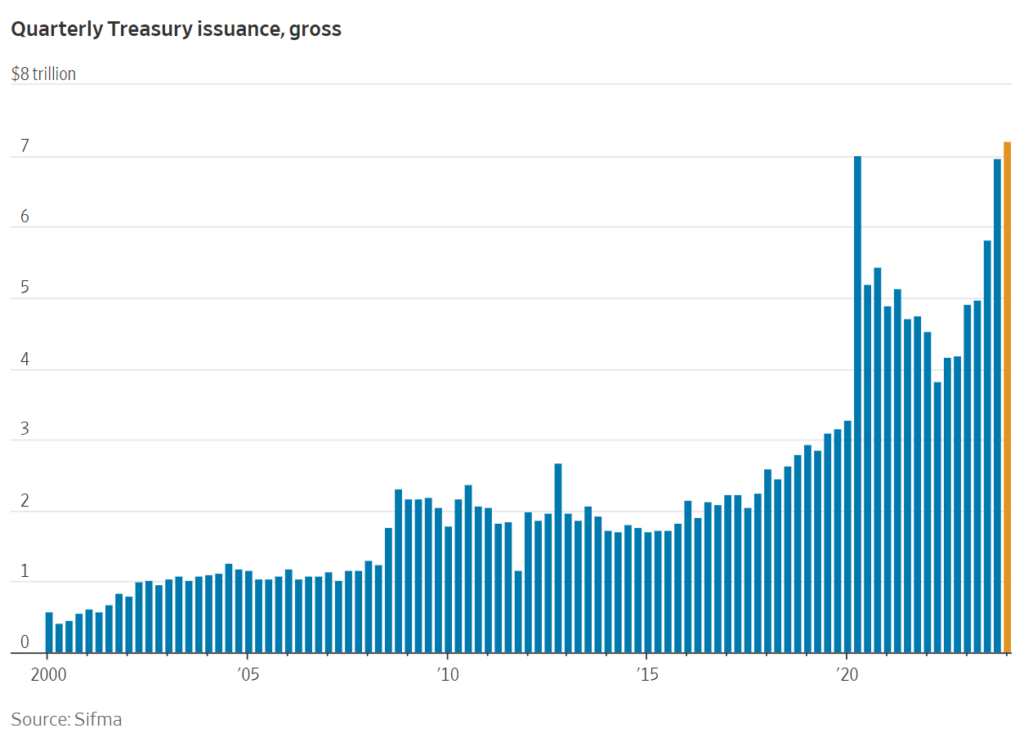

So, the Treasury Department regularly runs debt auctions to raise the cash necessary to keep the house of cards from crumbling for a little longer. This chart of the last 24 years gives you a really good—i.e. sad—visual of the degree to which the Treasury Dept. has issued more and more debt year after year to fund America’s spending addiction…

That tangerine line on the far right marks $7.2 trillion for the first three months of the year. “The largest quarterly total on record,” says the WSJ. The number even tops the second quarter of 2020, when Uncle Sam was financing COVID-19 stimulus plans.

In short, it’s a helluva lotta debt to sell.

Yet, fewer and fewer buyers are showing up to the auctions.

You might rightly wonder why…

Well, the sheer size of the debt means investors wonder if at some point they simply won’t be repaid… that Uncle Sam will default in some creative way that means they won’t recoup all of the money they’re owed.

Some are simply sending a message that America has got to get its shit in order; that the country’s finances are beginning to resemble those of southern Europe before the crisis struck in 2009 and austerity plans were the topic of the day. (That’s quite likely coming to America soon enough.)

And then there are the many who harbor nagging fears that—as I’ve been saying all along—inflation is not done toying with us yet.

Because inflation continues in its role as financial dominatrix over a submissive Uncle Sam, investors fear that higher interest rates will stick around for longer… and those higher interest rates spread across so much debt is a bad, bad thing.

Higher rates mean higher interest payments.

And higher interest payments make it increasingly costly for America to pay her debts. (Debt repayment is already nearly 15% of America’s 2024 budget.)

Both of those combined creates more than a little handwringing that keeps bond investors on the sidelines, which in itself births a vicious cycle: Higher rates mean higher interest payments… which necessitate more borrowing to cover those interest payments… which means a larger amount of bonds for sale in Treasury auctions… that fewer buyers are attending… which forces Treasury to reduce bond prices again to attract buyers… which means higher interest… which means higher debt repayment costs…

You can see that America is in the Ouroboros phase—the snake eating itself.

If buyers are reluctant to buy, then bond prices have to come down. It’s really no different than an eBay auction: If no one wants to buy your super-rare Beanie Baby for $50,000, then you’ll have to drop the price to a more realistic $5 to gin up some interest in a product few people actually want.

The caveat here is that in the upside-down world of bonds, dropping the bond’s price means the interest rate on that bond that Uncle Sam has to pay goes up.

And America needs higher interest rates like it needs yet another election fiasco.

I’m not convinced there’s an offramp for this cycle that’s painless and doesn’t involve Congress writing off some of its debt through a debt-restructuring—more commonly known as a default.

And if that happens, well, we’ve got an entirely different set of problems to worry about at that point. But that’s a different dispatch.

This is why I continually recommend gold, silver, Swiss francs, and bitcoin. A tiresome echo, I realize. But it is what it is, and the the “it” in this case is the savvy ways to protect your wealth from a crisis that is written in the stars at this point.

But maybe I’m wrong. Maybe nothing bad ever happens.

Maybe Treasury and the Fed and a Haitian witchdoctor find a magical solution to America’s increasingly problematic debt woes. If so, then I am wrong. Gold, silver, Swiss francs will stagnate, probably bitcoin too.

But if I am right…

More soon.