Numbers can lie. Numbers can speak the truth. Numbers can amaze.

For today’s dispatch, we’re going with Door #3. Numbers can amaze—as you’ll see by the numbers from a report last year showing why an energy crisis is quite likely baked into our future.

I term it an “energy super shock” because “energy crisis” seems too insignificant for what’s to come.

Here are the numbers:

- The Biden administration in late 2021 held the largest oil-and-gas lease sale ever: 80 million acres out in the Gulf of Mexico. The bidding ended with $192 million raised, a laughable $25 per acre. Nearly 97% of the bids were uncontested.

- A few months later, in early 2022, up for bid went 448,000 acres in the state of New York for the right to build a bunch of windmills. The bidding drew lots of competition, and ultimately concluded with cumulate bids of $4.37 billion, or about $9,000 per acre.

Now, green-energy fans will be all giddy and full of smiles.

But for those of us who realize the bigger problem at hand, those numbers say inflation will worsen, that Americans might not be able to afford power in some cases, and that family pocketbooks are soon to feel ravaged.

And green energy will be in position to do exactly fuck-all about it.

Now, as I regularly note, I’m not hostile toward green energy. I see lots of opportunities there. I own green-energy investments. And a world free of fossil-fuel emissions will be a better world.

However…

We are not ready for that world.

Lack of Investment Fueling the Crisis

Most importantly, we do not have the infrastructure in place to manage the transition as quickly as the greenies want it to happen. Or as quickly as the world needs it to happen.

“But, Jeff, you dunderhead—that $4.37 billion spent on New York windfarm land is precisely the type of infrastructure investment you’re yapping about!”

Yes. It is.

And it is precisely the root cause of the super-shock racing toward us.

See, the bigger problem here is that the world’s demand for energy is growing faster than the capacity of green energy to step up and cover the fossil-fuel shortfall.

And, yes, there is a shortfall.

Global oil demand crossed a record 103 million barrels per day back in June. That demand has continued to grow.

Daily oil production, meanwhile, is down to less than 101 million barrels. That two-million barrel deficit is likely to keep growing, or so say all the global energy agencies that track this kind of stuff.

Green energy can’t make up the shortfall because demand is growing faster than the ability for green energy to meet it.

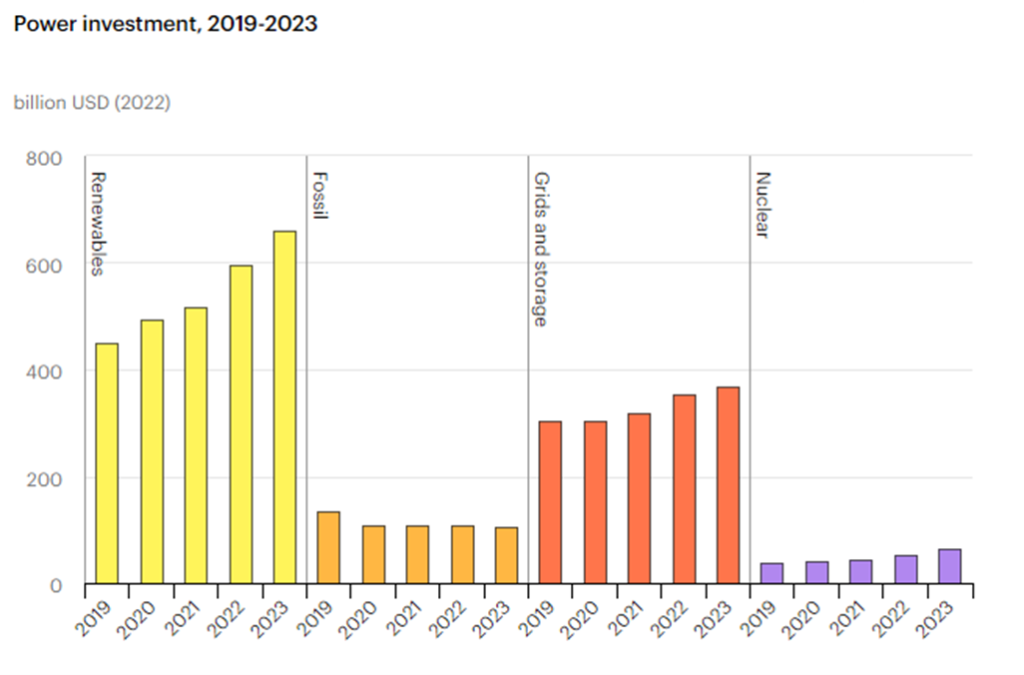

Yet green energy is sucking up almost all the financial oxygen. Consider this chart from the International Energy Agency:

Renewables are consuming a huge sum of investment dollars, while investment in fossil fuels has collapsed and is still falling.

Again, green energy zealots will cheer that and smile smugly.

Alas, that trend is problematic for everyone, because, as I noted above, green energy output isn’t growing fast enough to meet growing energy demand globally.

So, we face that coming energy super shock.

$150 Oil Will Become the Norm

Here’s what’s coming: Oil prices will rise sharply… natural gas, too.

My bet: $150 oil becomes the norm—with spikes to $200 or more on severe weather and unexpected events.

It’s not like the oil and gas companies can just turn on a spigot to increase supply. Developing oil and gas wells takes four to 10 years. Energy shortfalls that emerge today won’t see solutions until the back half of this decade.

But that’s assuming enough money flows into oil and gas exploration. The chart above says that’s wishful thinking.

Some of that $4.37 billion thrown at wind-farm land could have gone to developing any/many of the more than 9,000 drilling permits the U.S. has already approved but which the energy industry hasn’t yet used. Moreover, U.S. exploration companies have more than 10 years of unused oil and gas leases to call upon. But they don’t. That’s 14 million acres on land, and another 9 million acres offshore under lease, but which oil and gas exploration companies are not using to, well, explore for oil and gas.

Maybe the land offers poor prospects.

Yes, maybe. Then again, the Bureau of Land Management says at least 25% of those leases are on acreage with “medium or high potential for oil.”

Ok, well maybe the Feds aren’t willing to give exploration companies the green light.

Nope. Not the case here. Not even relevant.

At least 90% of the acreage is on state and private lands, where G-men have no voice.

Ok, well maybe unused permits and leases mean the industry isn’t interested in drilling because it knows the future is green?

Maybe. More likely it’s because it’s hard to gather up financing for the heavy costs of drilling wells—particularly deep-ocean wells—when so much cash is pouring into the green sector.

Higher Inflation Is On the Way

What we’re left with is a world grasping for as much power as it can gobble up. But it cannot rely on green energy to supply that increasing power. And it cannot rely on the fossil fuel industry because the industry can’t attract enough investment.

So, we will end up with higher and higher oil and gas prices.

And higher and higher inflation.

And deep pain in household pocketbooks.

We will end up with an energy super-shock that sees energy stocks shoot the moon.

Like I said at the outset, numbers can speak the truth… and they can amaze.

Get ready to be amazed by oil numbers to come.