“When cigarettes hit $1 a pack, I’m giving up smoking!”

That was what Mr. Gillen used to say back in the ’70s. He and his wife, Madeline, were effectively my surrogate parents. Though I lived with my grandparents, the Gillen family, four houses down, had three kids—Jim, Mike, and Michelle—and they were effectively my adopted siblings. I spent more time at their house than I did my own. That family pretty much raised me.

All these decades later, I still remember Mr. Gillen’s comment about cigarettes because I knew, even as a kid, that he was lying to himself. And, lo and behold, he never did kick the habit, even as the price for a pack of smokes rose past $1, then $2, then $3… then $5.

I think about that these days because I wonder what the typical American like Mr. Gillen will do when gasoline hits $10 per gallon…

That’s a big number!

It resonates.

You can viscerally feel the pain in your pocketbook just thinking about the cost of filling up your car or SUV when gas prices hit 10 bucks. Will you, like Mr. Gillen and his cigarettes, say “I’m giving up driving!” when that day comes?

Now, I know you’re probably thinking, “Why is gas going to $10, Jeff? Seems like clickbait to me.”

High Gas Prices Are Baked Into Our Future

Alas, I don’t write “$10 gasoline” as clickbait. Actually, I don’t write anything as clickbait. I write what I truly believe is likely to happen as I look out over the remainder of the decade.

And what I see is the energy “super shock” I keep warning about and which will bring us high gas prices.

That super shock is the reason $10 gasoline—likely even $15 gasoline—is in our future. But we’ll return to that momentarily.

First, let me say that we have passed the no-turning-back stage.

For years, we’ve dramatically underinvested in exploring for new sources of fossil fuels. Now, this cake is baked. You can’t underinvest for years, and then suddenly decide “You know, we need some more oil,” and pop into the backyard, plunk down a drilling rig, then simply wait for it to strike a big well.

This isn’t The Beverly Hillbillies. No one goes out, “shootin’ at some food, and up from the ground comes a bubblin’ crude.”

We’re now deep into what the energy industry calls the “investment gap.” That’s the chasm separating the investment needed to meet future oil demand, and the actual money oil companies are spending on finding new reserves.

Last year, investment banking behemoth Goldman Sachs told clients that energy-industry investment delays since 2014 mean the world will lose 10 million barrels of oil per day in production output (basically the production of Saudi Arabia) by 2024-2025. That starts as soon as next year.

At its peak last decade, the industry was spending close to $1 trillion a year looking for new reserves. In 2020, that fell to just $300 billion. Yes, 2020 was a rotten year all around, but spending has barely budged higher since then.

The ramifications of underinvestment do not show up quickly. They fester over time.

Think about not reinvesting in the upkeep of our house. Years 1, 2, 5, and even 12 probably mean nothing. All is pretty much the same. But then things start breaking. Termites have destroyed the structural integrity of the walls. Settling soils have cracked the foundation, allowing water to seep through and mold to colonize.

You can’t fix those problems quickly. And trying to do so will cost a ton of money.

How We Get to $10 Gasoline, At Minimum…

Goldman noted that spare energy production capacity is now pretty much nonexistent. The world doesn’t have a way to navigate supply disruptions. When they happen, disruptions simply cause energy prices to spike higher, even if only for a short time.

Which brings us back to $10 gasoline…

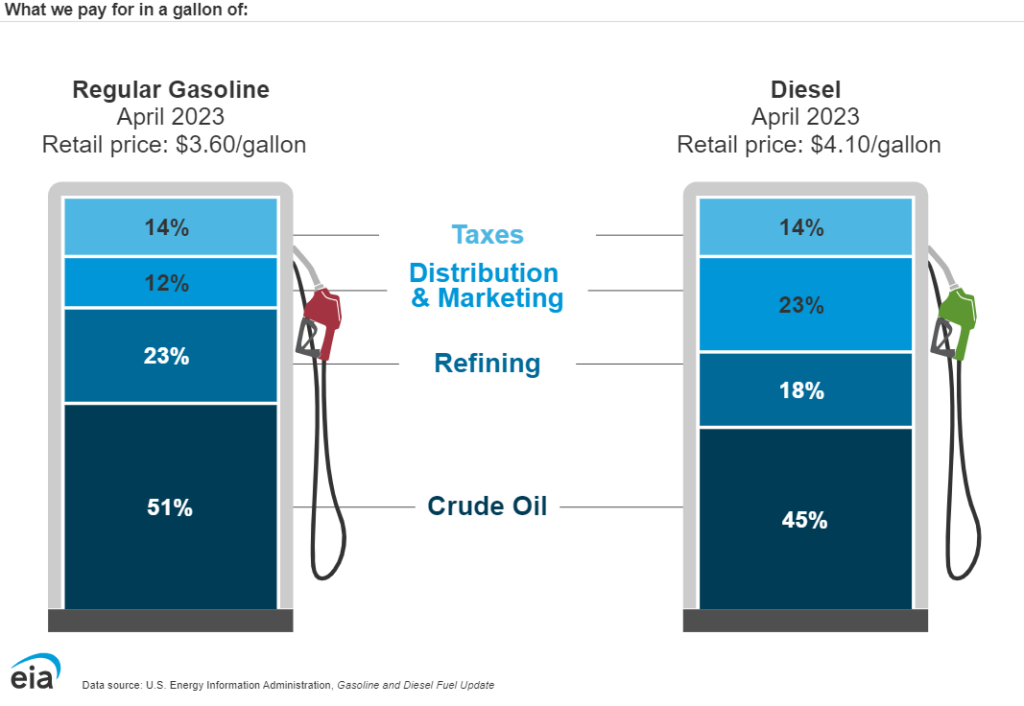

Here’s a graphic as of April from the U.S. Energy Information Administration. It breaks down what goes into the gas prices we pay at the pump. This is, of course, a national average. Prices vary all over the country because of differing tax structures, demand, transportation costs, etc. But this offers a good framework we can build on…

That $3.60 in April happened when oil was about $73 per barrel.

If we’re in an exploration spending deficit, as Goldman indicates—and as I have been writing about for a while—then we can expect oil prices to soar higher as demand exceeds supply later this year.

So, let’s push oil to $110 per barrel. Very loose math based on the chart above would imply gasoline prices at $5.40 or so. Another notch higher, $150 oil, puts us up close to $7.40 per gallon.

And push oil to $250 on an energy spike tied to some unknowable event, and suddenly we’re well above $12 per gallon. (And I can make the case for $15 gas, too.)

That’s not Chicken Little thinking. Big, unexpected events come out of nowhere all the time to shock the system and send oil prices—and, thus, gas prices—higher. The Ukraine war came out of nowhere, and oil that was just $66 per barrel in the winter of 2021 was well above $120 by June 2022—a price double in six short months.

Given that we’re barreling toward a supply crunch, oil at $150 per barrel is quite likely to be a new normal in the super shock that’s already unfolding.

That, in turn, means oil at $250 is more than possible on short-term spikes.

Splitting the middle, that puts gasoline prices at or around $10 per gallon.

At that point, will you stop driving?