How Gold Protects Your Wealth From Inflation

We start today’s dispatch in October 1996…

That particular October resonates with me to the degree that my son was born in that month. So, I randomly chose that month to make a point about a subject near and dear to my heart: Gold’s true role as inflation protection for our wealth.

Too many pundits today claim that gold is a pointless asset serving no purpose in an investment portfolio. They argue (amusingly) that it’s just a shiny rock… an archaic financial relic the simple-minded citizenry of centuries past employed. They scoff and say that in this modern, 21st-century age of money, gold has no seat at the table.

I love those pundits.

Their ignorance of history and their financial cocksuredness gives me a lot to write and laugh about.

Gold: The Great Inflation Protection Asset

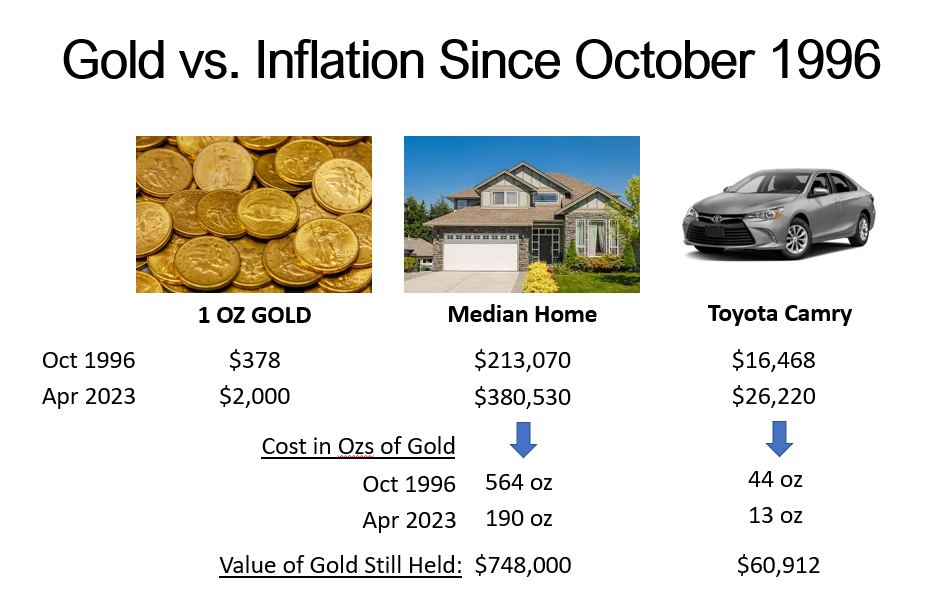

So, before we go any further, let us ponder a chart I ginned up. Together we can laugh at the anti-gold punditry…

This chart shows the increase in the price of gold, a median house, and a Toyota Camry (the #1 selling car in America) between October 1996 and this month. In 1996, a home cost the equivalent of 564 ounces of gold and a Camry cost 44 ounces. That’s a total of 608 ounces.

If you had bought 608 ounces of gold in October 1996, and then held them until this month, you could now buy the house and the Camry and still have $809,000 worth of gold left over, despite the increase in price that the house and the car both experienced.

That’s the power of gold to preserve your spending power over time.

That’s the power of gold to serve as an inflation-protection asset in your portfolio.

And here I will toss in the fact that, until recently, the last 27 years saw some pretty tepid inflation—just 2.5% on an annualized basis.

But even tepid inflation is corrosive.

Inflation Protection is Increasingly Important

The hike in median home prices in the chart above… it represents an annual inflation rate of just 2.17%. The Camry’s price inflated by just 1.74% per year.

Consider where we are today with inflation north of 6%. Fortune recently reported that an “overwhelming 82% of middle-income households have cut down on the amount of money they’re saving or reached into existing savings to make up for the shortfall in their incomes in the last three months of 2022 due to the higher cost of living.”

Another report from Horizon Media splits Americans into three categories—Resilient, Anxious, and Vulnerable—and found the “biggest kind of surprise to us was actually [the Resilient] are not as resilient as they were last year.”

In more succinct terms: Inflation is pinching most Americans quite hard.

It’s forcing them to change spending patterns. It’s demanding that they drain their savings to make ends meet.

Which means tomorrow will be that much more difficult because the nest egg they thought they had is no longer as well-feathered as it once was.

But anyone who packed away any decent amount of gold pre-2000, when no one really cared about gold, is not feeling nearly the same level of financial strain today. They can tap into their gold savings (if necessary) to supplement their income.

Lifestyle insurance, I call it.

Adding More Gold To My Portfolio All The Time

I never care what happens to gold prices from one year to the next. Such movements are pointless noise in the longer-term story of America’s increasingly fragile monetary situation and the ever-growing Everest of debt that will topple over at some point with devastating consequences for the dollar… but which will see gold shoot to prices that too many people today just can’t fathom.

Prices the pundits today would laugh at.

Laugh away, I say.

The history of gold smiles knowingly.

Which is why I keep adding gold to my portfolio here and there. I just recently looked inside my largest retirement account and saw it still holds a bunch of dollars that I didn’t realize were in there.

Those dollars are now being turned into more exposure to gold.

I don’t like where the U.S. monetary situation is headed. Nor do I like where inflation is headed. And I certainly don’t like where the Fed has steered America over the last few decades.

I see the reckoning that’s coming.

But I’m just one monkey in a large jungle over which I have zero control.

All I can do is stockpile bananas (i.e. gold) for the day it all goes to hell.