Tornado-Force Tailwinds Will Push These Assets Higher

Some of you are going to remember this…

Back as a kid in the 1970s, calling convenience stores and asking, “Do you have Sir Walter Raleigh in a can?”

The clerk would affirm that the shop does, indeed, have that brand of loose, pipe tobacco in stock.

And you’d reply with, “Well, you better let him out so he can breathe.” Then, hang up and laugh with your buddies at your sixth-grade antics.

The only reason my mind drifted to that moment is because these days I have King Charles in a vault.

As you very likely know from reading these missives, I am a fan of hard assets. Have been for well over a decade as I’ve watched the U.S. economy, society, and financial system devolve. No two ways about it: America is moving in the wrong direction.

But I accept the fact that I cannot change that. Best I can do is prepare for the enviable.

And for me, part of that preparation is sticking King Charles in a vault.

Why I Buy Silver Coins These Days

To be less opaque… I continue to buy silver coins at BullionStar in Singapore and then stick them in a local vault. That keeps some of my wealth secure offshore, and in one of the world’s safest legal and financial jurisdictions.

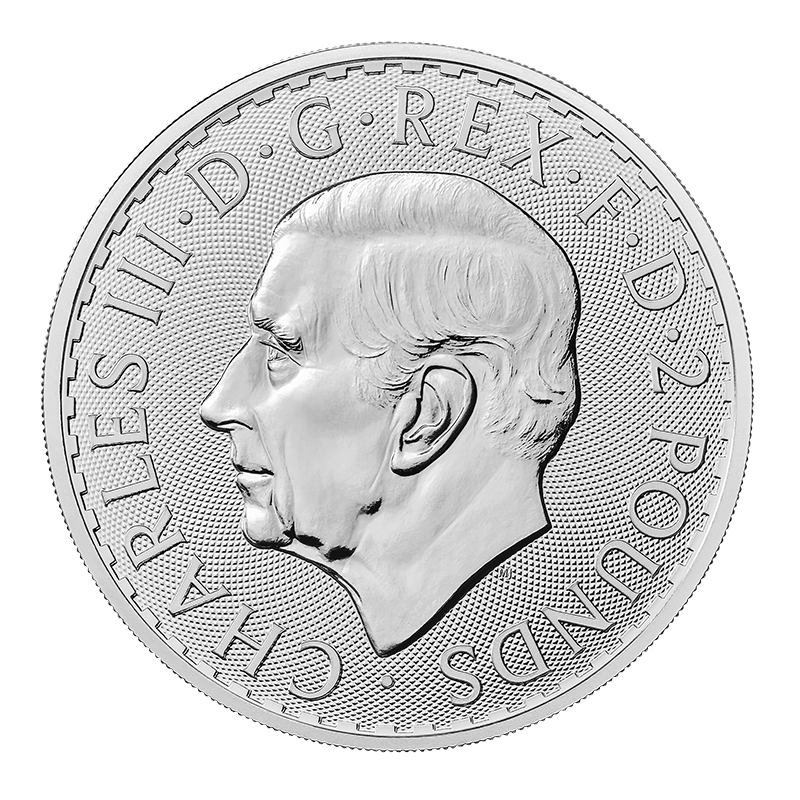

Most recently, I’ve grabbed a bunch of British Silver Britannias, the sovereign silver coins minted by the U.K.’s Royal Mint, the British version of the U.S. Treasury. Those Britannias feature an effigy of the new king of England, Charles III. This is what the coin looks like:

For the record, I also have Queen Elizabeth stuck in the vault, as well as a bunch of Silver Merlions from Singapore, and I’m just now buying some Silver Kangaroos from Down Under. These little fellas:

Since hitting its recent bottom last August, silver has quietly rallied nearly 35%, and is up more than 90% since its 2020 COVID-induced low. It’s following its big brother, gold, which is up more than 20% since last fall, and more than 60% post-COVID.

Both metals will see higher prices… much higher.

My bet: Gold, now at $1,980 per ounce, sees $3,400. And silver, now at $24 sees $136 to $170 per ounce—an epic move from current prices.

How do I justify such a move?

The Gold-to-Silver Ratio Says Silver Is Much Too Cheap

Well, investors have always measured the two metals against one another by means of the “gold-to-silver ratio”—or how many ounces of silver one can afford with the value of a single ounce of gold.

Based on gold and silver prices as I write this, that ratio is 82.5. I can spend $1,980 and get one ounce of gold, or 82.5 ounces of silver. That’s at the very high end of the ratio’s range, which over the last 110 years that the Federal Reserve has existed had oscillated between the low-teens and just over 111.

When the dollar crisis strikes, the gold-to-silver ratio is going to collapse because of emotion and affordability.

People fearful of their finances act rationally but in irrational ways. They know rationally that they must protect their wealth… but irrationally they will overpay for an asset that they perceive as a safe haven.

Moreover, people typically think in terms of quantity when buying investments. More just seems like, well, more. If I can buy one ounce of gold or 50 or 60 or 70 ounces of silver… bigger sounds better. Mentally, we think there’s a better chance that silver rises from $24 to $50 or $100 than there is for gold to rise from $1,980 to $4,000 or $7,500.

Because of that, people in panic will likely dive into lower-priced silver, and we’re going to see the gold-to-silver ratio plunge to between 20 and 25, which implies silver at $136 to $170 per ounce when gold is at $3,400.

Thus, silver is one of the ways I’m protecting my wealth.

I Have Faith When I Buy Silver … Not So Much Holding Dollars

I have increasingly narrow faith in the U.S. dollar because of the amount of debt under which Uncle Sam is buried. I don’t care if Dick Cheney and others claim “deficits don’t matter” to a sovereign nation. I’ve said it before, and I’ll keep saying it: Debts and deficits absolutely matter, otherwise money has no value.

Plus, as I’ve noted before, when it comes to the debt fight, government is not the 800-pound gorilla in the room.

The bond market is.

The moment bond investors get a whiff of monetary trouble, they can force radical changes on a government. We saw it in the early ’70s with Nixon having to take the dollar off the gold standard. We saw it in the ’90s when George Soros broke the Bank of England. And we saw it last year when the bond market crushed new U.K. Prime Minister Liz Truss and forced her to backtrack on her budget plans and then to resign in disgrace.

The markets, ultimately, wield the biggest stick in the fight.

When the reckoning arrives—and it will, this decade—hard assets like gold, silver, and industrial commodities like copper will see tornado-force tailwinds. The value of dollar assets will decline, but the value of non-dollar hard assets will take flight.

So it is, then, that I buy silver and I stick King Charles in a vault.

And I’m not letting him out to breathe.